Foreign Purchase ( Import LC)

Convenient Solution for All Stages of Procurement

Regular purchase operations can be challenging if not managed properly. PrismSCM is a one-stop solution for processing both local and foreign purchases efficiently and accurately, saving significant costs and effort.

Benefits

- Purchase Return & Exchange

- Purchase VAT Calculation

- Purchase Cancellation

- Increased Revenue

- Purchase Invoice

- Purchase Request

Core Features

- Procurement Reference Tracker

- Purchase Order Management

- Purchase Return & Exchange

- Purchase VAT Calculation

- Quotation Comparison

- Purchase Cancellation

- Supply Chain Analysis

- Purchase LC (Import)

- Product Requisition

- Purchase Request

Import LC (Letter of Credit)

PrismERP's Import LC Management system simplifies and streamlines the management of import Letters of Credit (LCs). Designed for businesses, it ensures efficient tracking of financial and document statuses, while its user-friendly interface enables quick proficiency in handling LCs. Key features include managing third-party commissions, associating costs with imported goods, and integrating invoices, goods receipts, and payment information.

The system also supports indenting activities for indenters, enhancing task management and overall organizational efficiency. With PrismERP, businesses can ensure compliance and smooth transactions by following a clear, structured process for managing Import LCs, a bank's unconditional payment promise to suppliers, contingent on meeting specified terms.

Key Feature

- Purchase/Work Order Management

- Proforma Invoice(PI) Management

- Import LC

- LC Amendment

- Document/Commercial Invoice(CI) Management

- LC Expenditure

- Landed Cost

- LC Loan Management

- Final Settlement

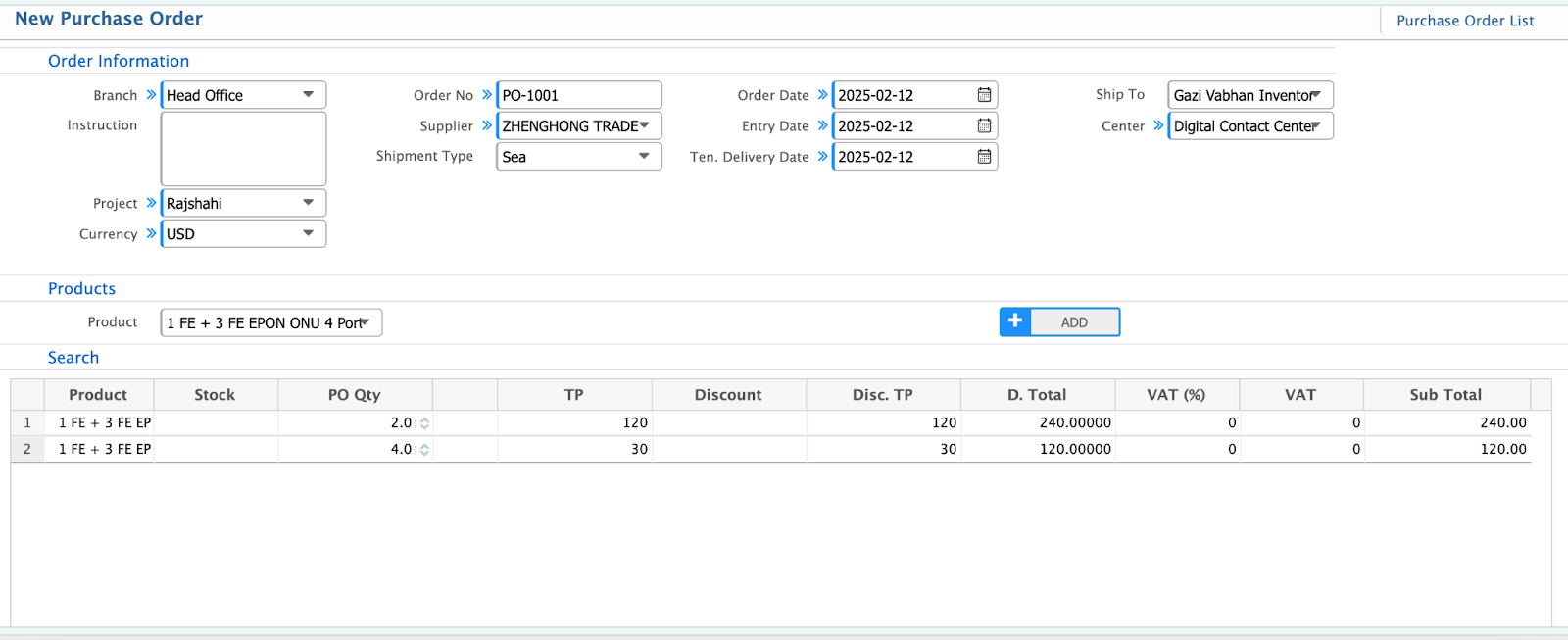

Purchase Order

With PrismERP’s LC Management, importers can efficiently manage and send new purchase orders to exporters along with detailed product information. This feature streamlines the process of managing Import Letters of Credit (LCs), allowing businesses to specify product details, quantities, and terms directly in the system. The seamless integration ensures accuracy, reduces manual errors, and facilitates better communication between importers and exporters, making the LC process more transparent and efficient.

A Purchase Order in PrismERP’s LC Management module ensures clarity and traceability throughout the import process by encompassing the following key details:

- Order Number: A unique identifier generated to track the purchase order against the buyer within the system.

- Supplier Name: The name of the supplier company associated with the purchase order.

- Buyer Name: The name of the exporter to whom the purchase order is being sent for importing products.

- Currency: The type of currency in which the purchase order is performed, ensuring accurate financial transactions.

- Entry Date: The date the purchase order is recorded in the system.

- Order Date: The date the purchase order is officially created.

- Tentative Delivery Date: The expected delivery date of the goods or products being imported.

- Branch: The branch from which the purchase order is placed.

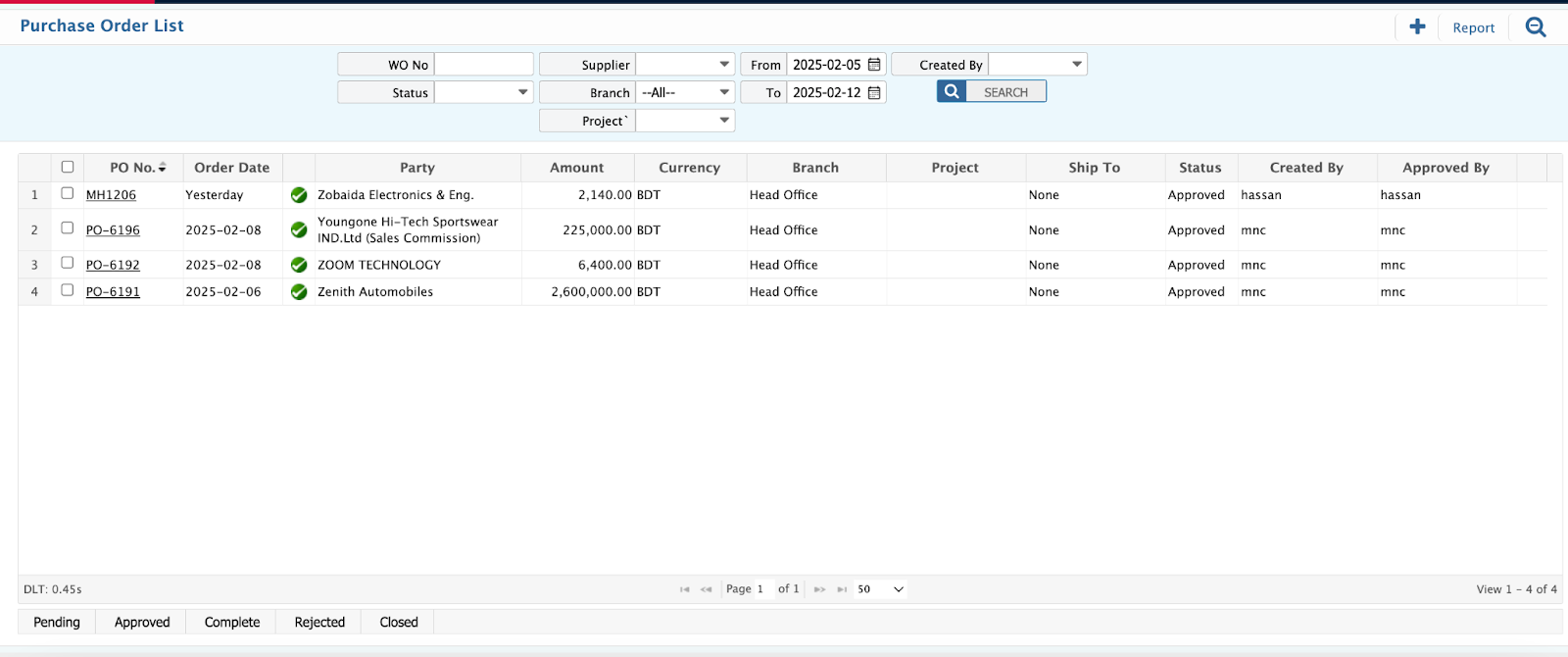

Purchase Order List

The purchase orders List Page provides a user-friendly interface for managing all purchase orders. Key features include: search fields like order no, supplier, from date, to date. From the list page, you can manage the order status.

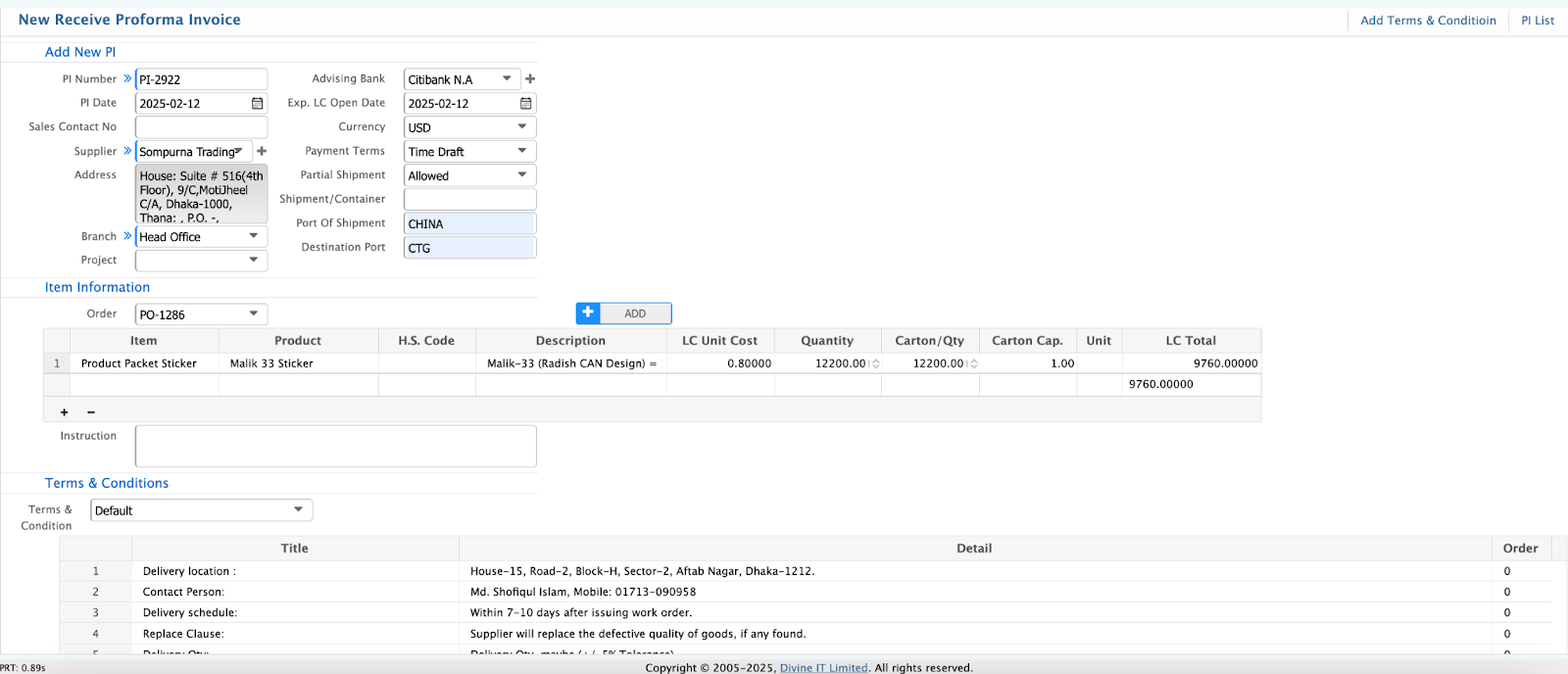

Proforma Invoice

PrismERP’s LC Management module enables efficient handling of received Proforma Invoices from exporters. This feature ensures seamless management of key aspects of the invoice, including:

- Currency: Supports multi-currency handling to maintain accuracy in international transactions.

- Payment Terms: Facilitates clear definition and tracking of agreed payment conditions.

- Advising Bank: Tracks the bank acting as an intermediary for the export process.

- Partial Shipment: Manages terms for partial shipment, ensuring flexibility in delivery.

- Terms & Conditions: Enables documentation of detailed terms governing the transaction.

- Additional Clause: Provides a section to include any specific clauses or special requirements for the transaction.

Proforma Invoice Details:

- PI Number: A unique identifier for the invoice issued by the exporter.

- PI Date: The date when the Proforma Invoice was created.

- Advising Bank: The buyer/exporter’s bank responsible for generating the Letter of Credit (LC).

- Exp LC Open Date: The expiration date for the opened LC.

- Currency: Specifies the currency used for payment transactions.

- Payment Terms: Defines the agreed terms for payment, such as Time Draft, Deferred, Sight Draft, or Usance.

- Partial Shipment: Indicates whether the shipment is allowed in parts or must be delivered altogether (Allow/Not Allowed).

- Shipment/Container: Identifies the shipment or container transporting the goods.

- Port of Shipment: The port from which the buyer/exporter’s shipment originates (e.g., Beijing, Hong Kong).

- Destination Port: The receiving port where the goods will be delivered.

- Order: Links the Proforma Invoice to the specific work order being processed.

By clicking the "Add Product" button, users can add products to the invoice. The product details will appear in a table below, displaying essential information such as LC Unit Cost, Quantity, LC Total, and more.

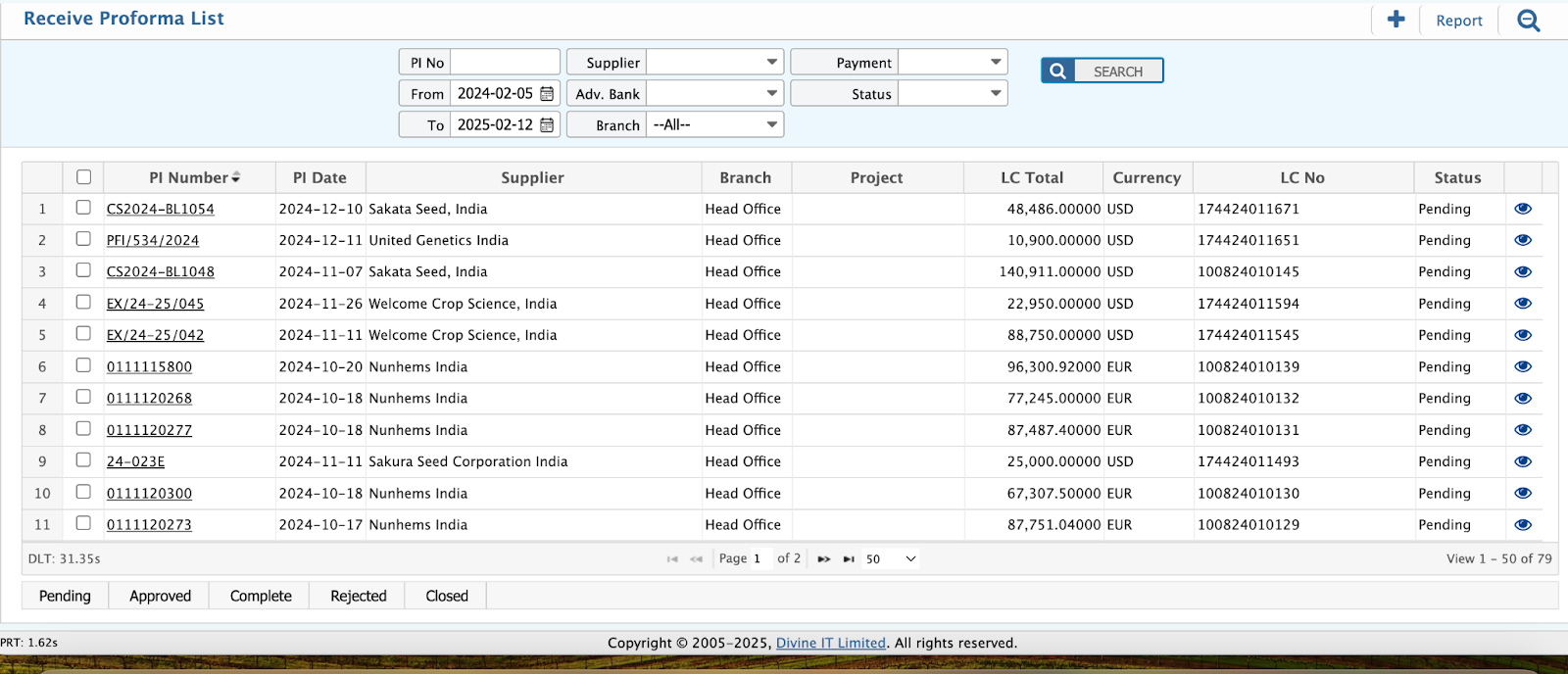

Proforma Invoice List

The Proforma Invoices List Page provides a user-friendly interface for managing all Proforma Invoices. Key features include: search fields like PI no, supplier, from date, to date. From the list page, you can manage the order status.

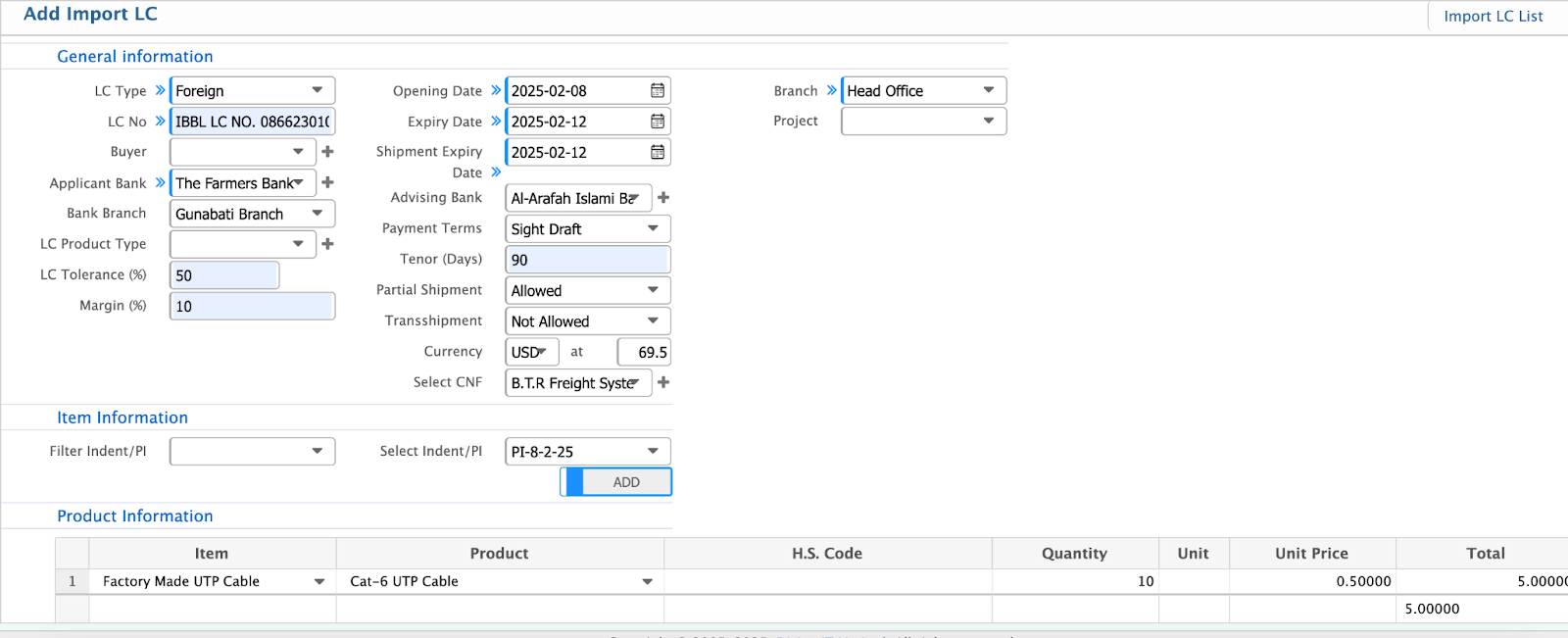

Import LC

PrismERP’s Import LC module empowers users to efficiently manage and control critical aspects of Letter of Credit (LC) processes. The system supports the following functionalities:

- LC Tolerance: Users can define and control the percentage tolerance for quantity or value variations in the LC.

- Margin: Manage LC margin amounts and ensure financial accuracy.

- Buyer and Supplier Details: Associate LCs with specific buyers and suppliers for streamlined tracking.

- Date Control: Monitor and set key dates such as LC expiry date and shipment expiry date.

- CNF (Cost & Freight) Agent: Manage CNF agent details for logistics and freight handling.

- Currency: Specify the currency used in the LC for international transactions.

- Advising Bank: Manage the advising bank responsible for facilitating the LC.

- Applicant Bank: Track the applicant bank generating the LC.

Additional Features:

- LC Creation from Multiple Sources: The system allows creating LCs based on multiple Proforma Invoices or Indents, offering flexibility in sourcing.

- Expense Management: PrismERP handles LC-related expenses, such as:

- Bank Charges

- Insurance Cover Note

- Margin Charges

PrismERP’s Import LC module encompasses all critical information required to manage and monitor Letters of Credit (LC) seamlessly. Below are the core components captured in the system:

- LC Type: Specifies the type of LC, such as Local, Foreign, or EPZ (Export Processing Zone).

- LC No: A unique LC number generated for efficient tracking within the system.

- S/C No: Reference to the sales contract or contact person.

- Supplier: Name of the supplier company involved in the LC.

- Buyer: Name of the buyer to whom the goods are being imported.

- Indent Agent: Optional field for the name of the agent or indenter facilitating the LC process.

- Applicant Bank Name: The name of the importer’s bank issuing the LC.

- LC Product Type: Defines the category or type of product associated with the LC.

- LC Tolerance: Percentage allowance for variations in loan value, provided by the issuing bank.

- Margin: Specifies the marginal value set for the LC.

- Branch: The branch responsible for handling the LC.

Key Dates:

- Opening Date: Date when the LC is initiated.

- Expiry Date: Final validity date of the LC.

- Shipment Expiry Date: Deadline for the shipment under the LC.

- Advising Bank: The bank representing the exporter or buyer.

- Payment Terms: Specifies the payment mode, such as time draft or other conditions.

- Tenor (Days): Number of days required for shipping the goods.

- Partial Shipment: Option to allow or disallow the breakdown of shipments.

- Transhipment: Optional details of the transhipment or agent responsible for goods transfer.

- Currency: The currency in which the LC transactions are conducted.

- CNF (Clear & Forwarding Agent): Details of the agent handling the logistics and clearance processes.

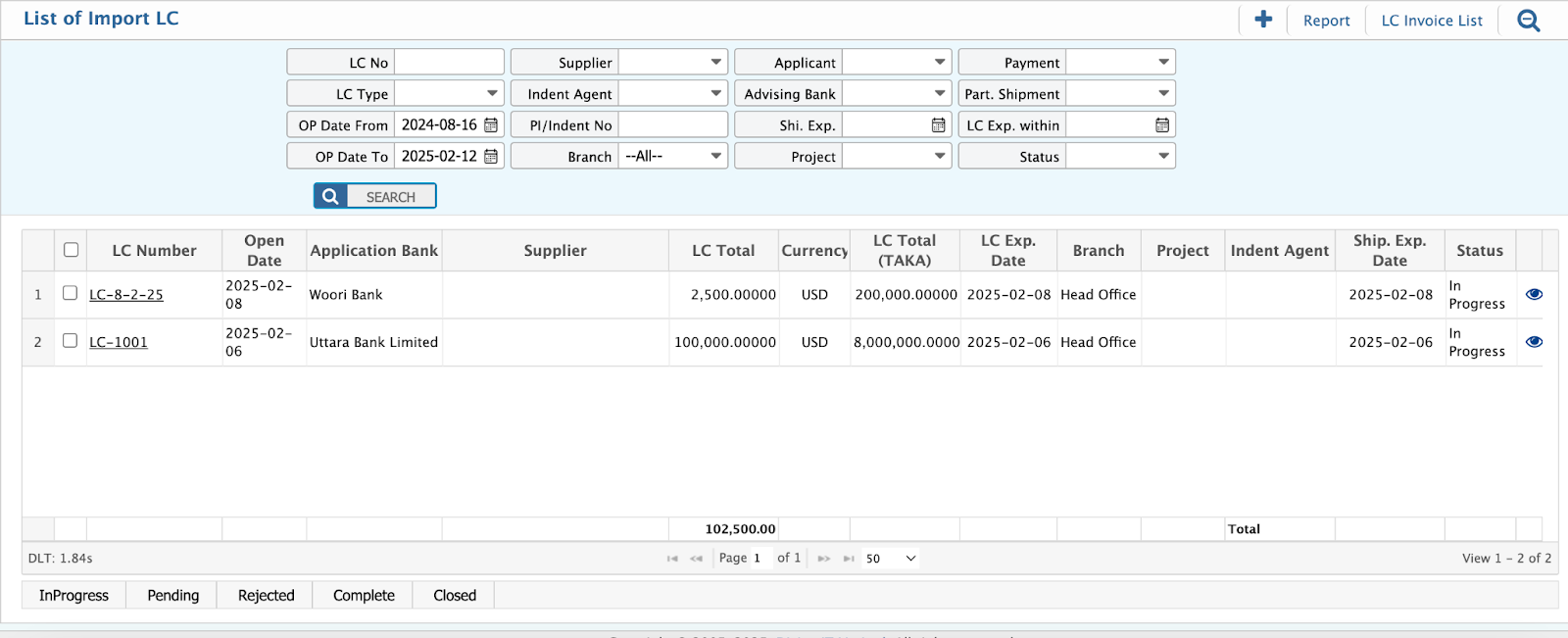

Import LC List

The Import LCs List Page provides a user-friendly interface for managing all Import LCs. Key features include: search fields like PI no, supplier, from date, to date. From the list page, you can manage the order status.

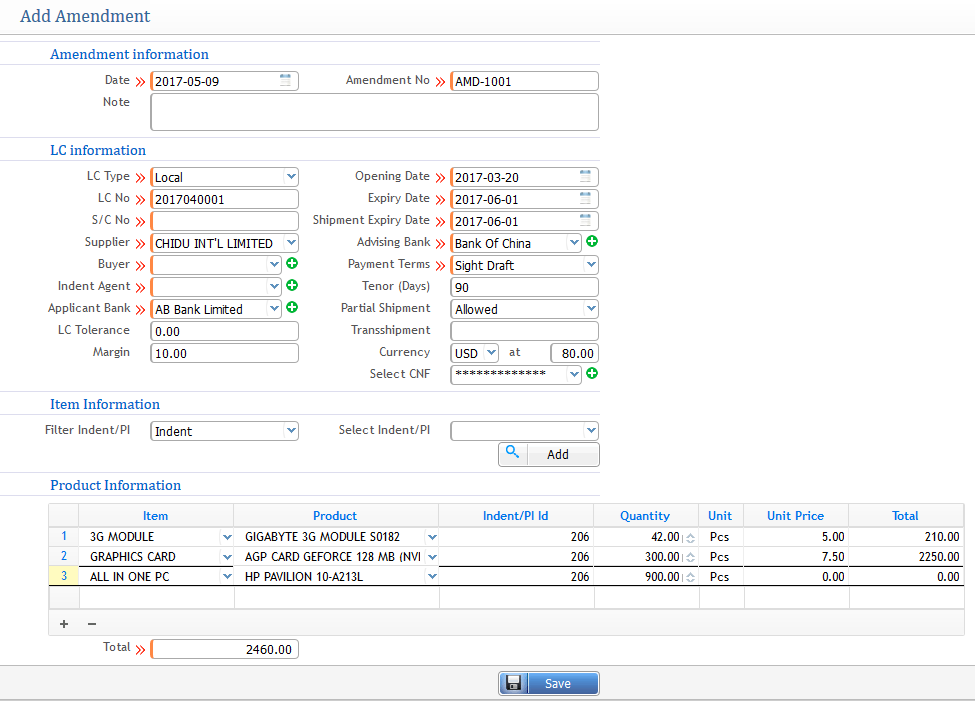

Amendment

Amending a Letter of Credit (LC) is a common scenario that arises when changes or corrections are required after the LC has been issued. This may occur due to:

- Errors in the original application by the applicant.

- Requests from the beneficiary after reviewing the LC document.

Amendment Workflow:

- Initiation of Amendment: The applicant or beneficiary identifies the need for an amendment. This could involve changes to terms, dates, or other LC details.

- Request to Issuing Bank: The applicant submits a formal request to the issuing bank for an amendment.

- Issuing Bank Action: The issuing bank reviews the request and, if approved, issues the amendment.

PrismERP’s Role:

PrismERP simplifies this process with its user-friendly interface, enabling users to:

- Track and manage LC amendment requests efficiently.

- Make updates to critical fields such as shipment dates, payment terms, or currency.

- Ensure all amendments are recorded in the system for accurate tracking and reporting.

- Maintain compliance with banking and trade regulations during the amendment process.

With PrismERP, businesses can handle LC amendments seamlessly, minimizing delays and ensuring smooth international trade operations.

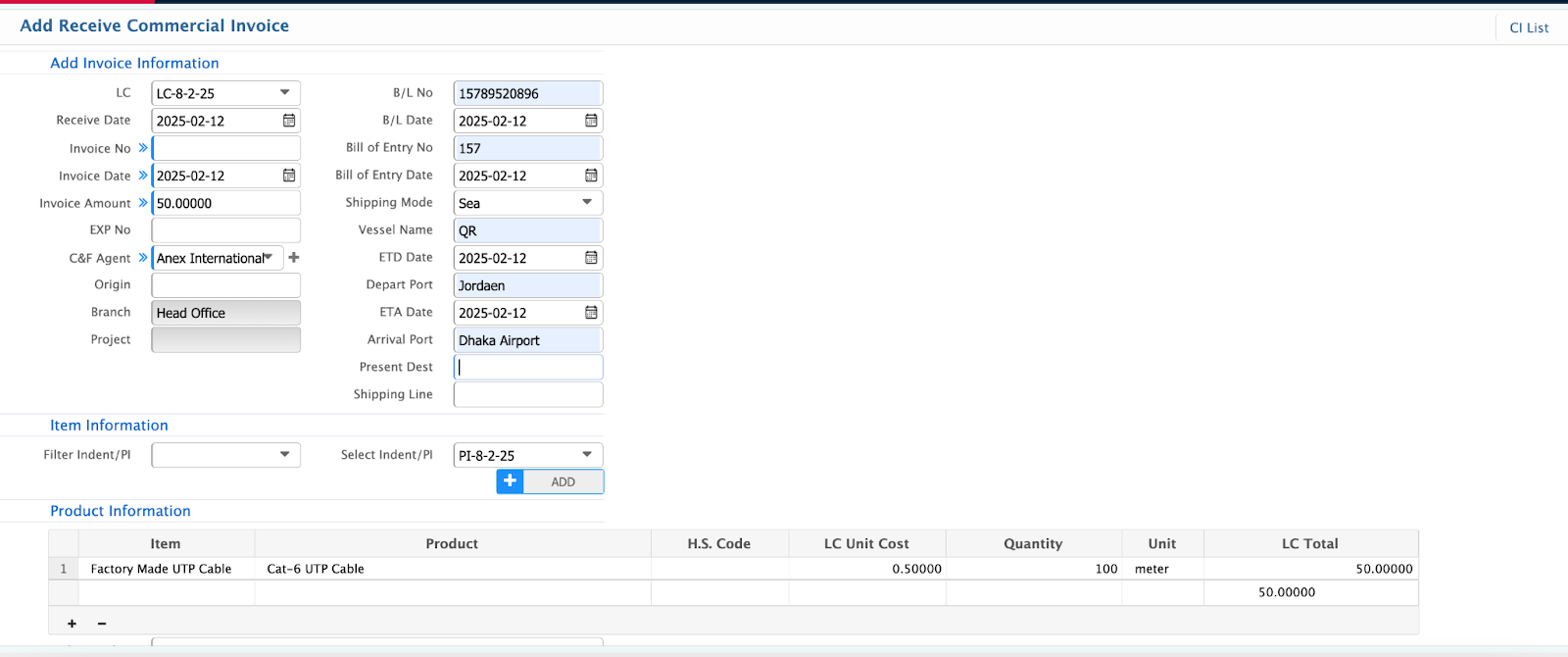

Commercial Invoice

A commercial invoice is a commercial document used mostly in international trade transactions. It is a document required by customs to determine the true value of the imported goods, for assessment of duties and taxes.

Key Information on Commercial Invoice:

- LC Number: The LC number under which the transaction is taking place, ensuring it links with the letter of credit.

- Commercial Invoice Number: The unique number generated by PrismERP to track the commercial invoice in the system.

- Commercial Invoice Date: The date when the commercial invoice is issued.

- C&F Agent: The name of the Clear & Forwarding (C&F) agent managing the shipping process.

- B/L No and Date: The Bill of Lading number and its issue date, providing shipping details.

- Bill of Entry No and Date: The Bill of Entry number and date, required for customs clearance.

- Estimated Departure Date & Port: The expected date of departure and the port of departure.

- Estimated Arrival Date: The expected date of arrival at the destination port.

- Shipping Line: The name of the shipping line handling the transportation of goods.

- Product Information: Details about the goods being sold, including product names, unit costs, quantities, etc.

Commercial Invoice Expenses Management:

PrismERP allows you to track and manage various expenses related to the commercial invoice, ensuring complete transparency and compliance with legal requirements. These expenses may include:

- Customs Duty

- AIT (Advance Income Tax)

- VAT (Value Added Tax)

- Regulatory Duty

- Supplementary Duty

- Taxes

Commercial Invoice Expenses Management:

PrismERP allows you to track and manage various expenses related to the commercial invoice, ensuring complete transparency and compliance with legal requirements. These expenses may include:

- Customs Duty: The fee charged by the customs authorities.

- AIT (Advance Income Tax): The tax withheld on goods and services.

- VAT (Value Added Tax): Tax applied on the value of goods and services.

- Regulatory Duty: A duty that is levied to comply with specific regulations.

- Supplementary Duty: Additional duty charges that may be imposed.

- Taxes: Any other applicable taxes on the goods being imported.

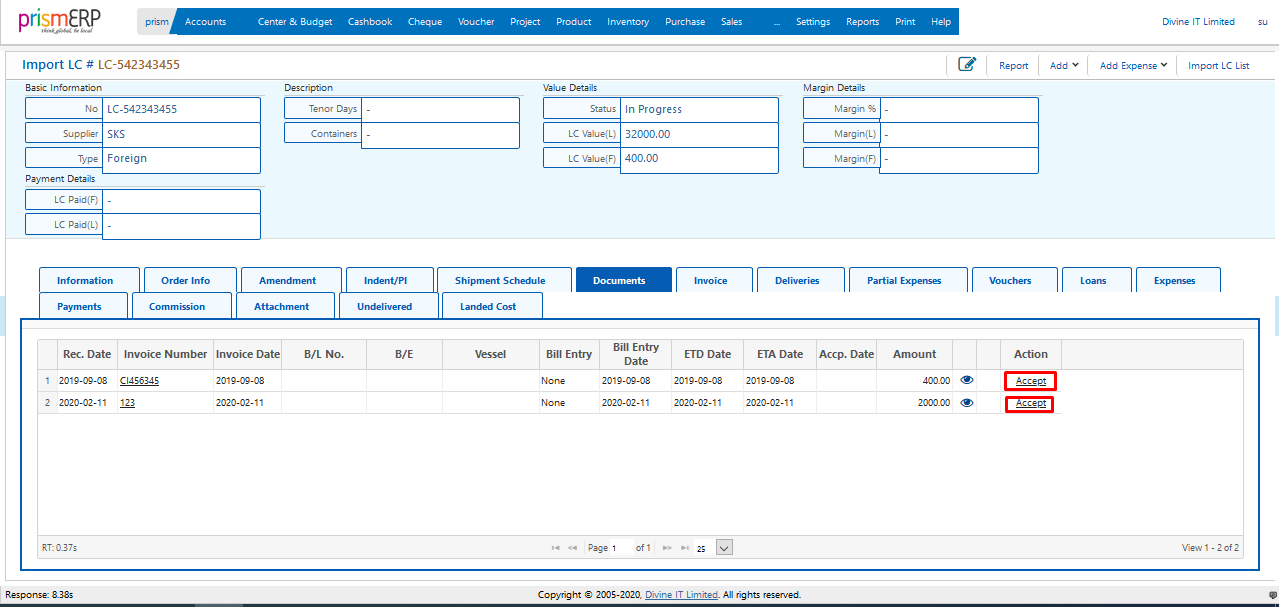

Commercial Invoice List:

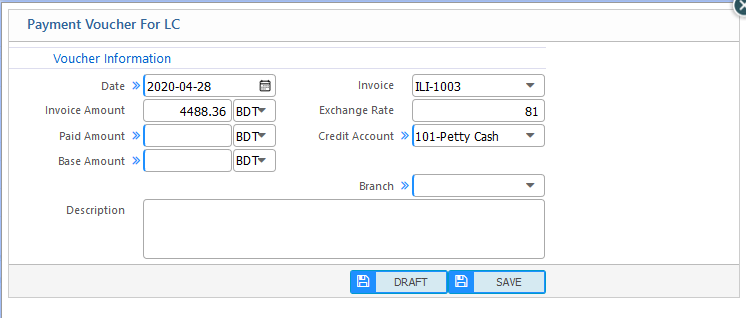

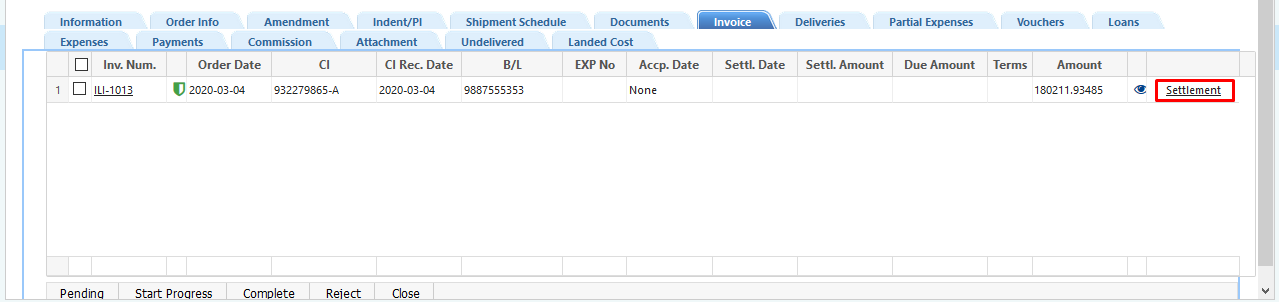

Need to accept the commercial invoice then create the ILI (Import LC Invoice) auto. Like as below.

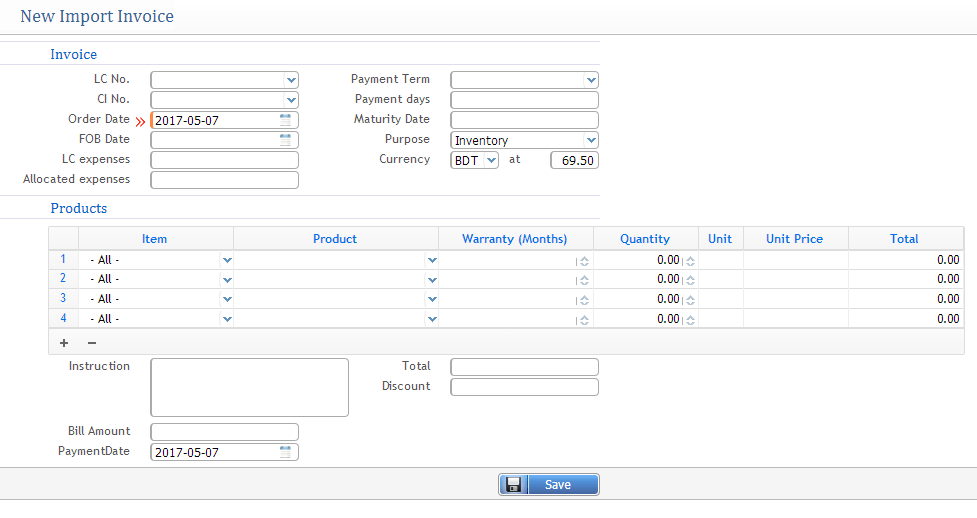

Import Invoice

After accepting the Commercial Invoice, an import invoice will be generated like a purchase order with proper accounting. When products are in-house, a delivery entry can be created from this invoice to update the inventory. Also, LC can be settled from the import invoice.

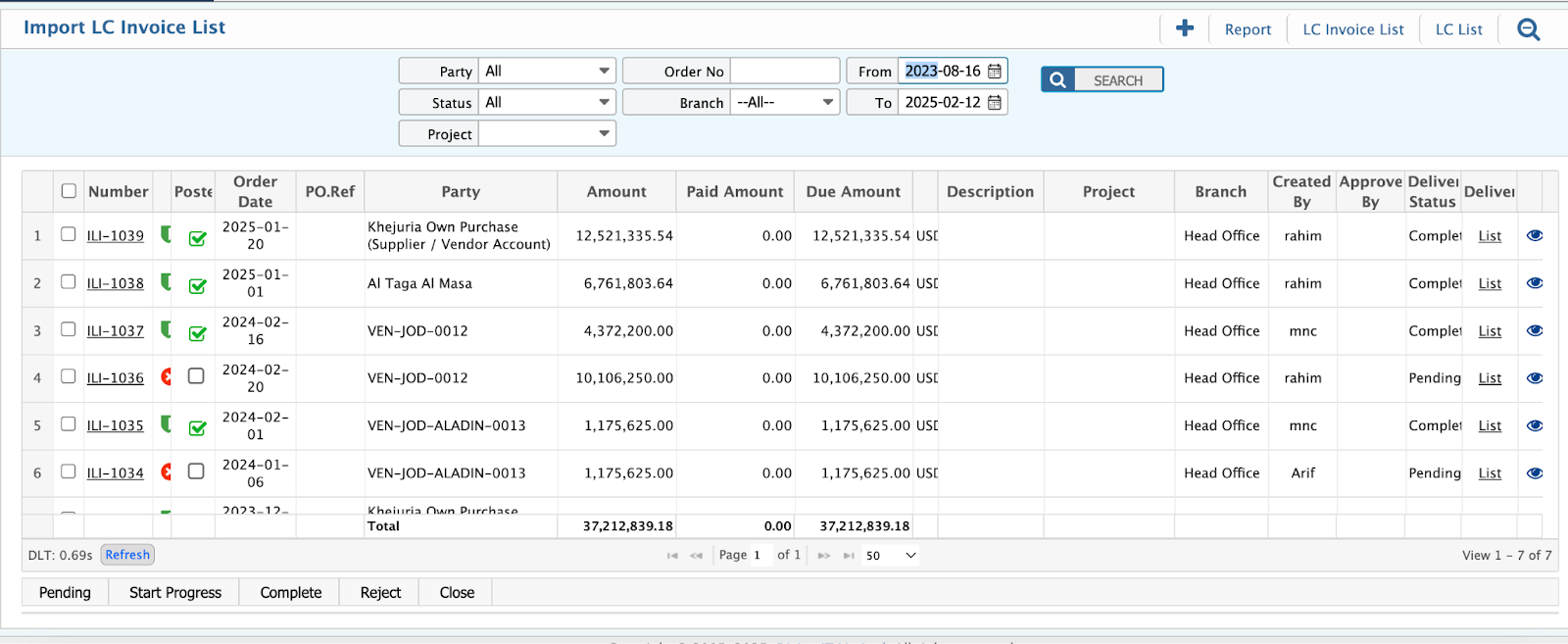

Import Invoice List

The Import invoices List Page provides a user-friendly interface for managing all Import LCs. Key features include: search fields like order no, supplier, from date, to date. From the list page, you can manage the order status.

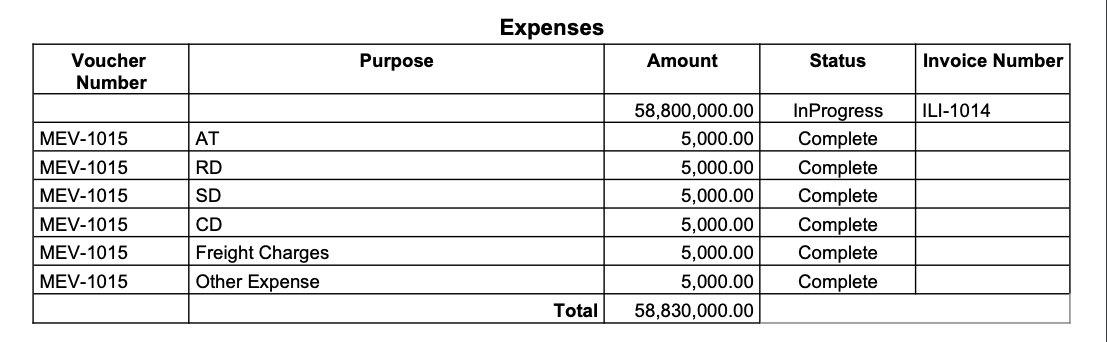

LC Expenditure

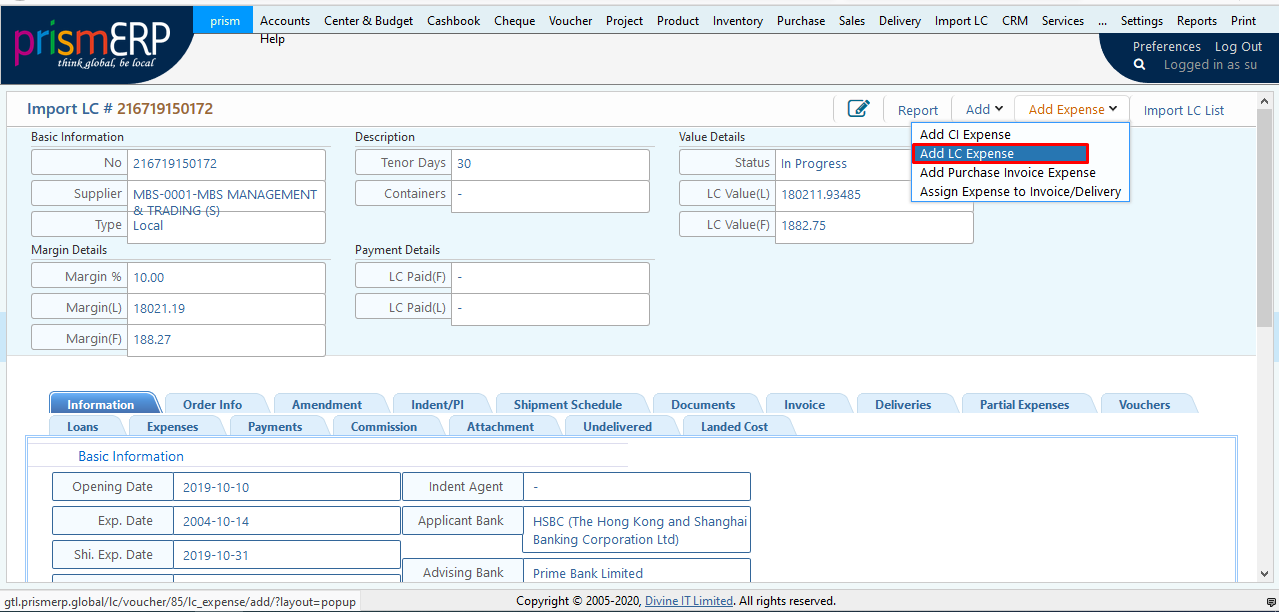

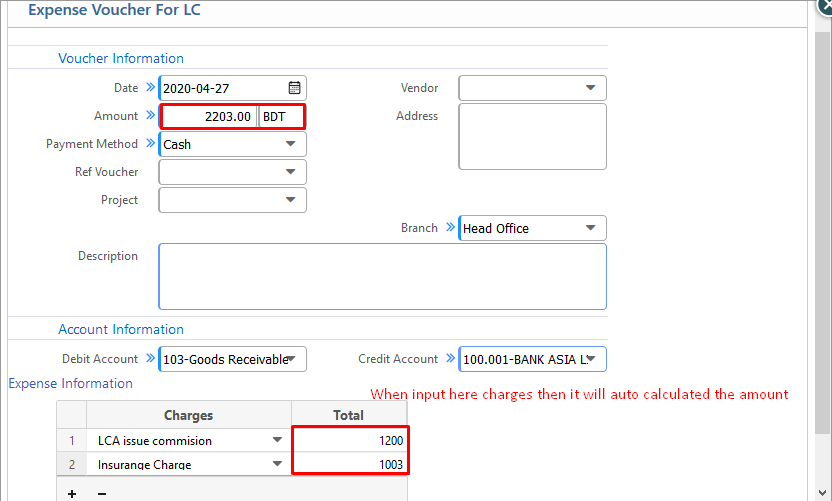

LC Expenditure option can also be performed from the LC process. This can be done in a similar process like the Amendment. First, go to any specific import number from the list, then on that specific corner click on the Add button to see the menu.

From the above screenshot you can see on the top right corner menu of Add . The red portion highlighted is the LC expenditure option. By Clicking on that will appear a window of LC expense.

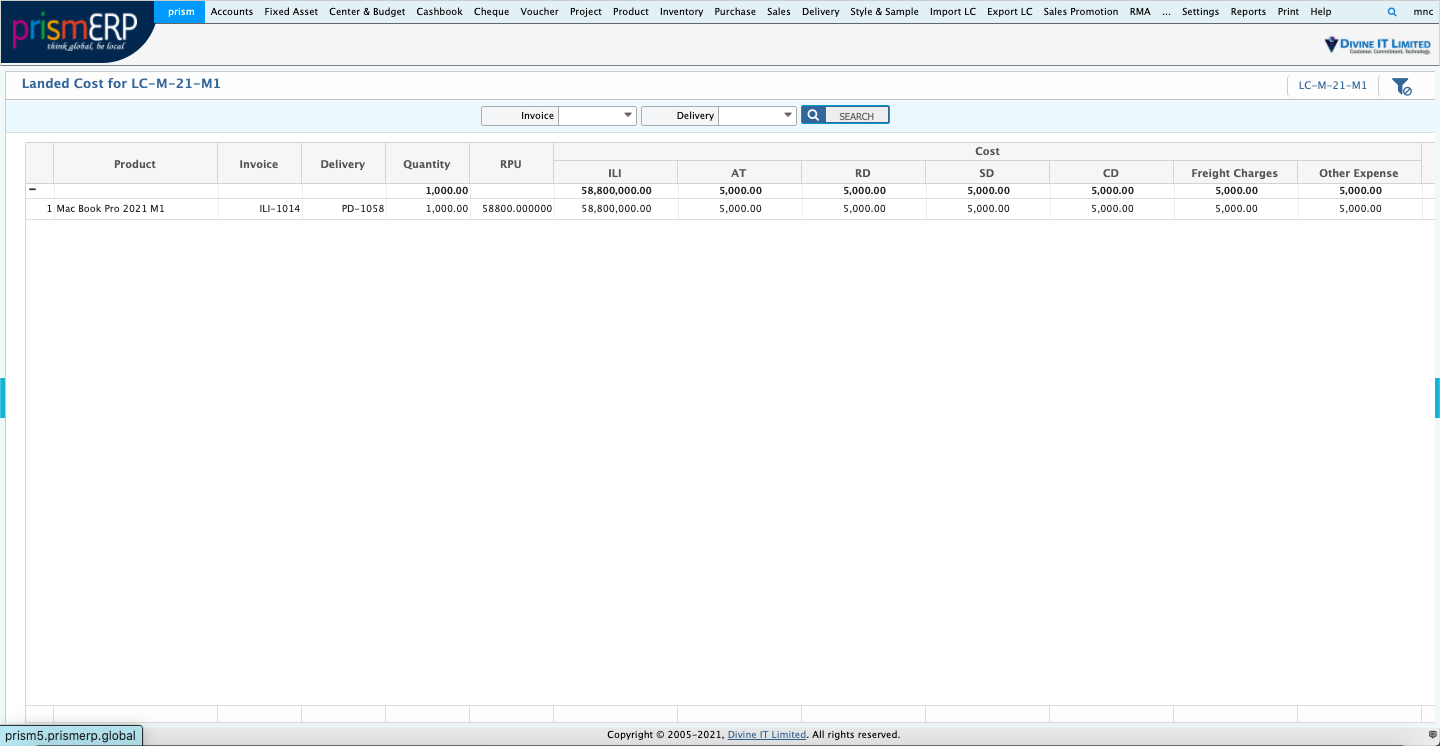

Landed Cost

The system shall automatically calculate the landed cost (LC) for a corresponding Letter of Credit (LC) upon completion of all related expense and duty entries. The following steps outline the process:

Expense and Duty Entry:

- All applicable expenses (e.g., freight, handling charges, insurance, etc.) and duties (e.g., import duties, taxes, and other applicable fees) related to the specific LC must be recorded in the system.

- Each entry must be accurately categorized and linked to the corresponding LC.

Validation of Entries:

- The system will validate that all necessary expenses and duties have been entered.

- If required, users may be prompted to confirm that no additional expenses or duties are pending before initiating the calculation.

Landed Cost Calculation:

Once all entries are confirmed, the system will compute the total landed cost. The landed cost will include the following components:

- Product Cost: The original cost of the goods as per the invoice.

- Freight and Shipping Costs: Costs incurred during transportation to the destination.

- Insurance Costs: Insurance premiums paid for the shipment.

- Duties and Taxes: Any import/export duties or taxes applicable to the shipment.

- Miscellaneous Costs: Any other charges directly related to the shipment.

Calculation Formula:

Landed Cost = Product Cost + Freight Costs + Insurance Costs + Duties and Taxes + Miscellaneous Costs

System Output:

- The calculated landed cost will be displayed or recorded against the respective LC.

- Users may view a detailed breakdown of the components contributing to the landed cost.

- The system should also update relevant reports and dashboards to reflect the updated landed cost.

LC Loan Management

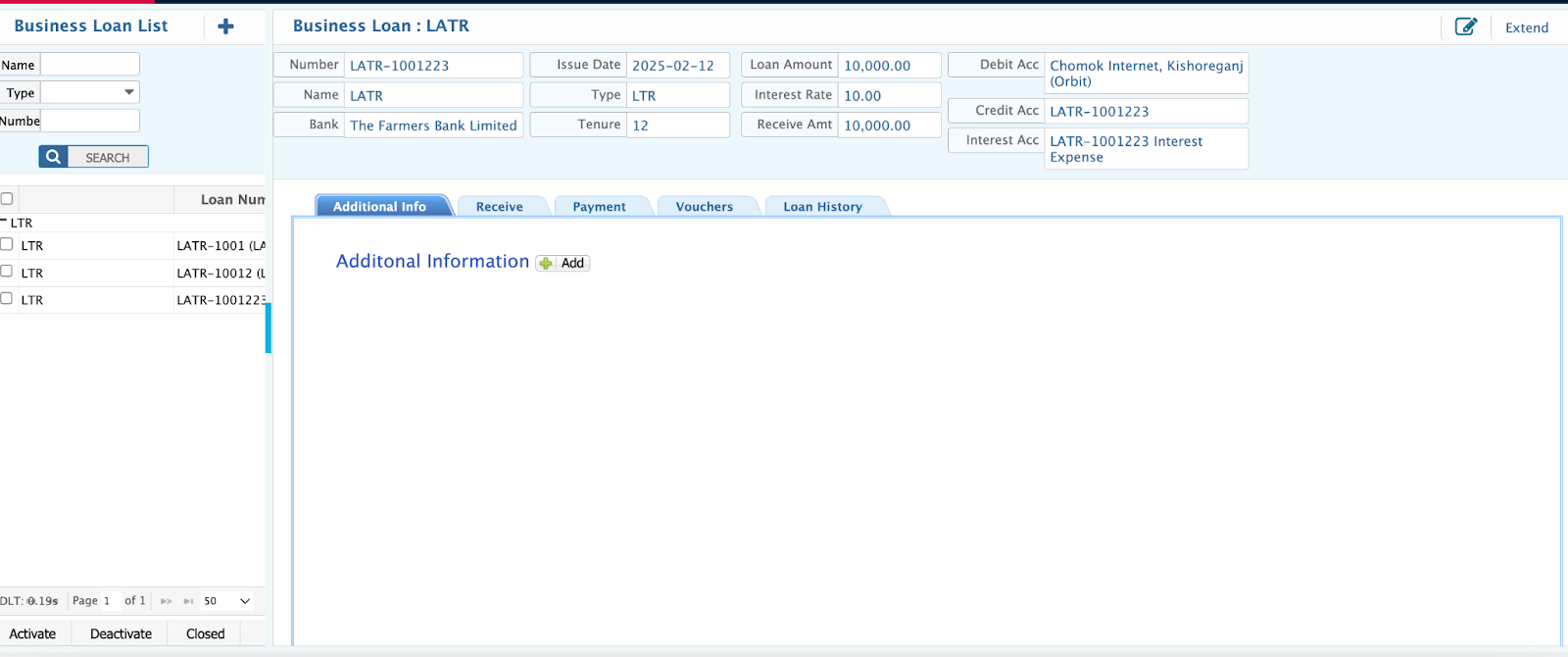

LC loans are a significant aspect of managing financial transactions for many companies, especially in import operations. PrismERP simplifies the management of these loans by providing a comprehensive system to handle different types of loans like LTR (Loan Against Trust Receipt), Time Loan, LIM (Loan in Import), and more.

Key Features of the LC Loan Module in PrismERP:

- Loan Creation from Import Invoice: Once an import invoice is processed, an LC loan can be created directly from it, streamlining the loan generation process.

- Variety of Loan Types: PrismERP supports a range of loan types:

- LTR (Loan Against Trust Receipt): A loan issued against goods imported by the buyer.

- Time Loan: Loans with a predefined repayment schedule.

- LIM (Loan in Import): A type of loan specifically designed for importing goods.

- Credit Accounts for Loans: For every loan, a new credit account is created in the system. This allows for easy tracking and management of the loan balance and repayment status. All loan-related transactions will occur through this account, ensuring accurate financial records.

- Interest & Bank Charges Management: PrismERP provides a flexible solution for calculating and managing loan interest as well as bank charges associated with each loan type. This ensures transparency and helps companies avoid mismanagement of finances.

The LC loan management feature in PrismERP is crucial for companies dealing with imports, as it streamlines the loan application, tracking, and repayment processes, while also ensuring financial operations are aligned with loan terms.

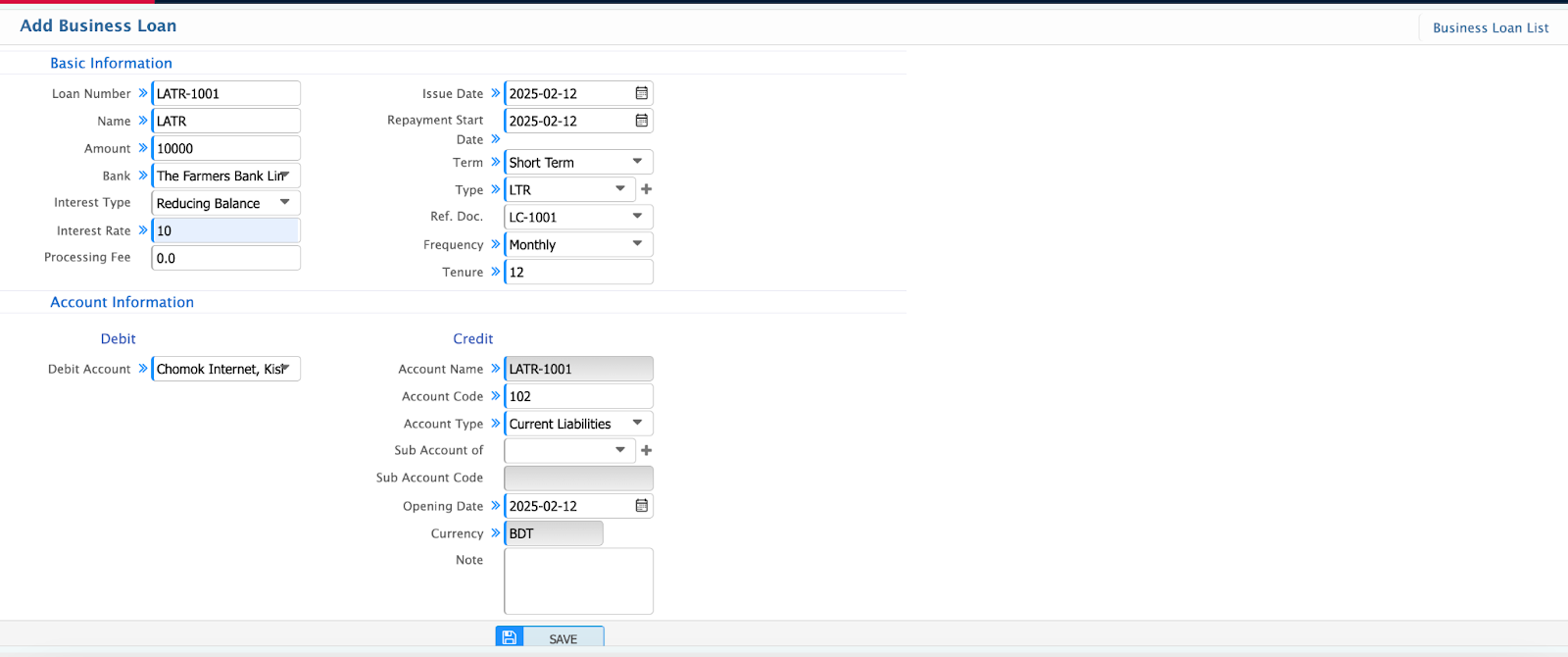

LC Loan Management Form Fields:

The LC Loan management feature in PrismERP provides a structured and detailed approach to handling loans for import transactions. Below are the key fields for adding an LC loan:

Key Fields in the LC Loan Form:

- Loan Number: A unique identifier for each loan, allowing easy tracking in the system.

- Name: The name assigned to the loan, usually indicating its purpose or type.

- Amount: The total amount of the loan taken from the bank.

- Bank: The name of the bank from which the loan is taken. This helps track the source of financing for the loan.

- Interest Type: Specifies how interest will be calculated or deducted. This can be either from the loan balance or through a different method, depending on the loan terms.

- Interest: The percentage of interest applied to the loan, which will be used to calculate the interest payments.

- Processing Fee: A fee charged by the company for processing the loan, which could be for administrative or setup purposes.

- Issue Date: The date when the loan is issued, which is important for tracking the loan’s life cycle.

- Repayment Start Date: The date on which the loan repayment begins.

- Terms: Describes whether the loan is a long-term or short-term loan. This will define the repayment structure.

- Type: The specific type of loan, such as LTR, Time Loan, or LIM. This determines the loan’s nature and repayment terms.

- Frequency: Specifies how often repayments will be made, e.g., monthly, quarterly, or annually.

- Tenure: The number of installments required to repay the loan. This is typically tied to the frequency and terms of the loan.

Account Information:

- Debit Account: The account where the loan amount will be credited initially.

- Credit Account: The account where repayments will be debited from, ensuring a clear record of the loan’s financial movements.

- Account Name and Code: The specific names and codes for the accounts involved in the loan transactions, helping ensure proper bookkeeping.

LC Loan List

Summary: PrismERP's LC Loan feature allows you to manage every detail related to an import loan, from the basic loan details to the complex aspects like interest rates, repayment terms, and associated fees. The system ensures that all financial movements tied to the loan are properly tracked and recorded, providing a seamless experience in managing LC-related loans.

LC Settlement

Add Settlement