EMI-Based Salary Loan

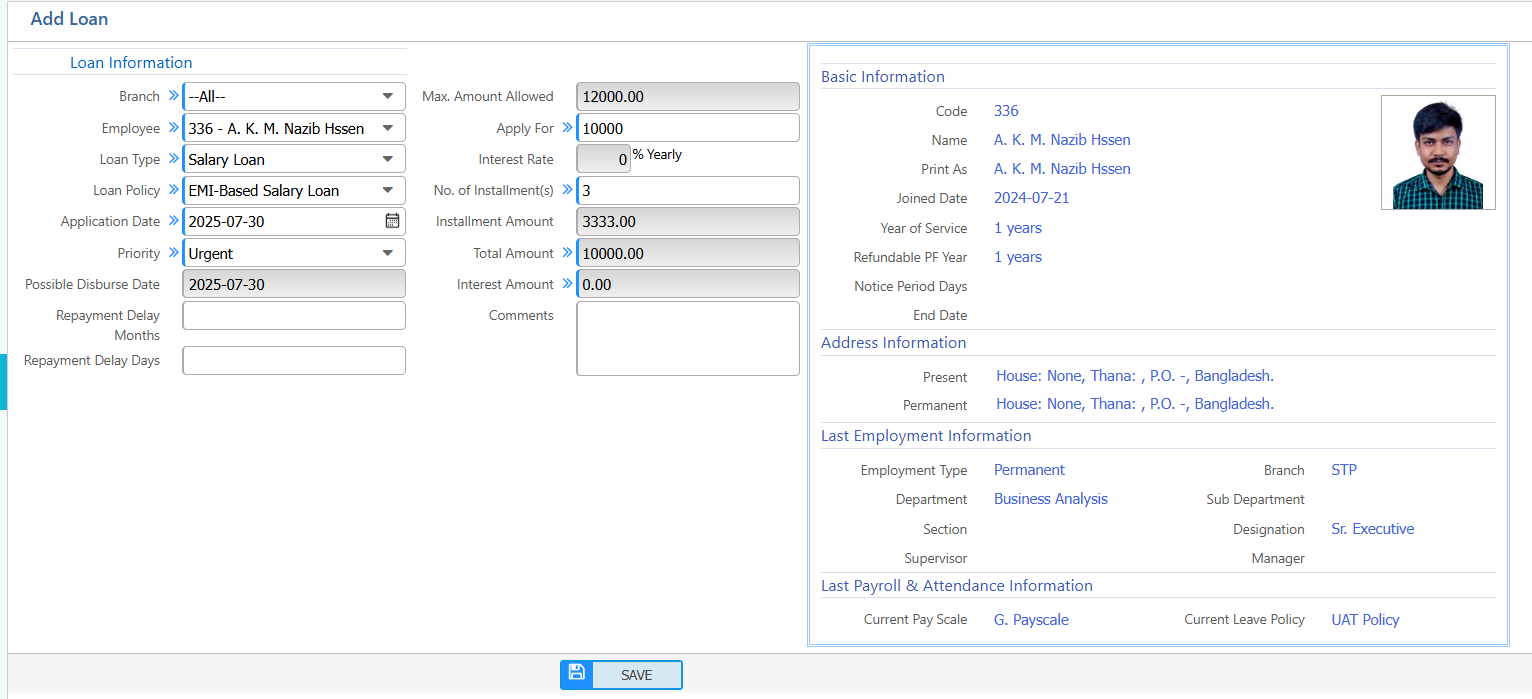

The EMI-Based Salary Loan feature in PrismERP allows organizations to manage employee loans with fixed monthly repayments deducted directly from salaries. This feature automates the loan lifecycle—from issuance to recovery—ensuring financial discipline and transparency for both the employer and employee.

Key Features

- Create and manage salary loans with EMI (Equated Monthly Installment) structure.

- Auto-calculation of EMI based on loan amount, interest rate, and tenure.

- Set deduction start date, EMI frequency, and repayment duration.

- View loan summary, outstanding balance, and EMI schedule per employee.

- Integration with payroll for automatic EMI deduction.

- Ability to pre-close loans or reschedule payments (based on configuration).

- Loan status tracking: Active, Closed, Overdue.

- Audit logs and loan history for transparency.

How to Use This Feature in PrismERP

➤ Issue the Loan

- Select the employee

- Choose loan type

- Enter amount, interest rate, and tenure

➤ EMI Schedule Generation

- System automatically calculates the monthly EMI

- Generates a full repayment schedule

➤ Start EMI Deduction

- EMI is deducted from the employee’s salary starting from the defined deduction month

➤ Track Repayment

- Monitor loan balance

- Check EMI payment status

- View overdue amounts if applicable

➤ Close or Reschedule Loan

- If needed, close the loan early or reschedule EMIs based on updated terms and approvals