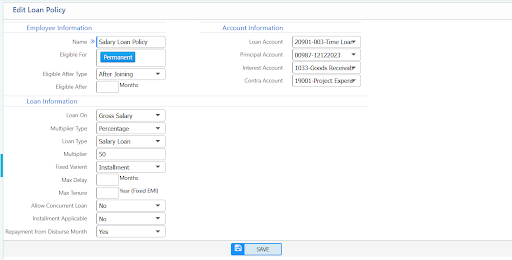

Salary Loan Configuration

The Salary Loan Configuration feature in PrismERP enables HR and Payroll administrators to predefine and manage settings related to employee salary loans. It allows organizations to set rules, eligibility criteria, limits, interest rates, and repayment terms, ensuring standardized and policy-compliant salary loan issuance.

Key Features

- Configure multiple loan types with customizable parameters.

- Set maximum loan limits based on employee grade, salary, or tenure.

- Define interest rates, loan tenure, and installment options (EMIs).

- Enable or disable pre-closure and rescheduling policies.

- Set eligibility rules such as minimum service period, employment status, etc.

- Integrate with payroll to apply loan deductions automatically.

- Assign approvers or workflow for loan issuance.

How to Use This Feature in PrismERP

➤ Access Loan Configuration

Open the Salary Loan Configuration settings under the relevant module.

➤ Define Loan Types

Create different loan types (e.g., Housing Loan, Personal Loan) with rules like maximum amount, interest, and tenure.

➤ Set Eligibility Criteria

Add conditions based on employee attributes such as designation, duration of service, or salary band.

➤ Configure EMI Terms

Set installment frequency (monthly), deduction start date, interest calculation method, etc.

➤ Link with Payroll

Ensure the settings are integrated so that EMI deductions reflect automatically during salary processing.

➤ Apply Settings

When a loan is issued, these predefined configurations apply by default, streamlining the issuance and recovery process.