Loan & Advance Manager with EMI

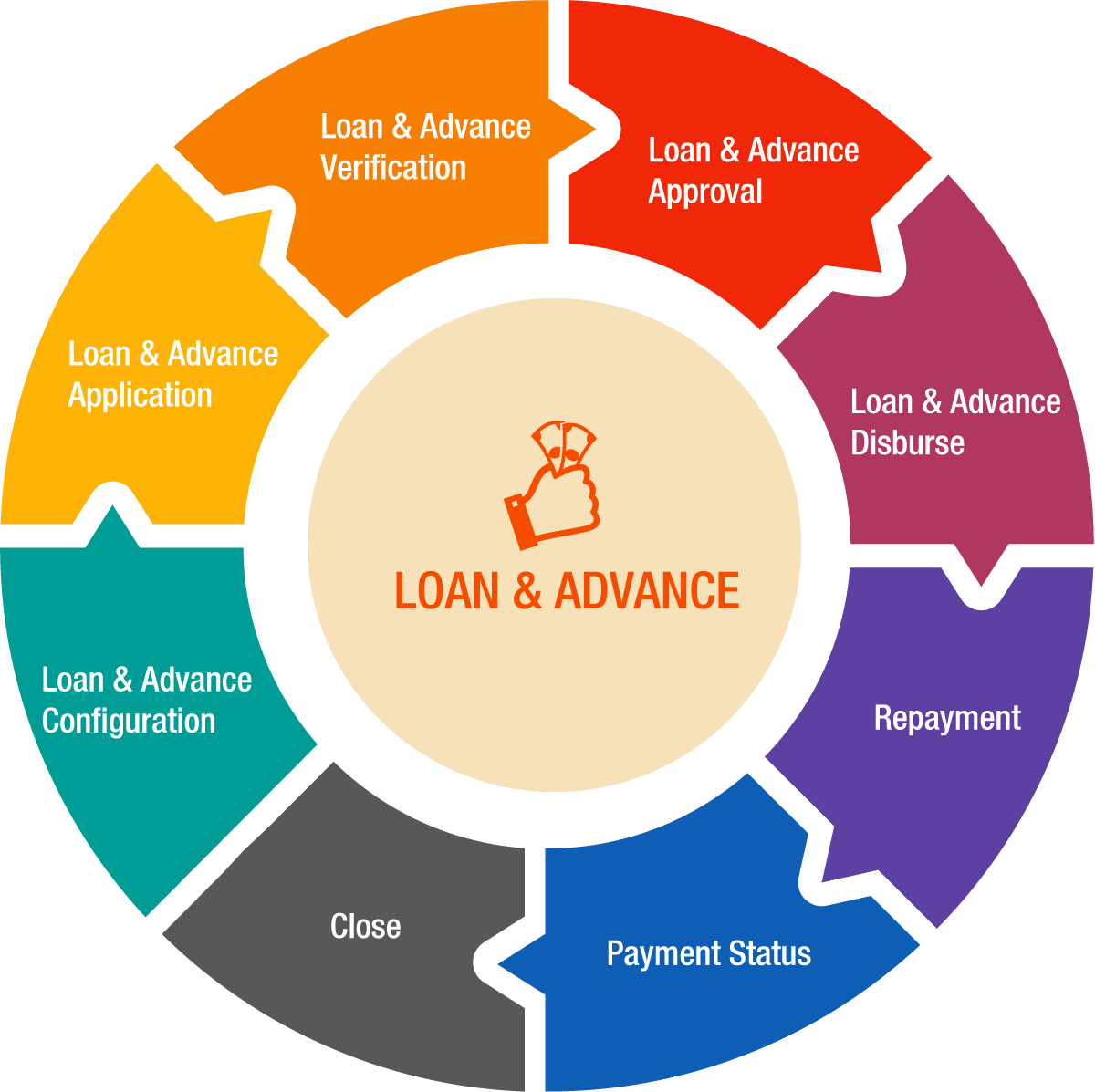

The Loan & Advance Manager with EMI feature in PrismERP enables organizations to manage employee loans and salary advances efficiently. It allows HR and Accounts teams to define loan types, issue loans, configure repayment plans with EMI options, and monitor outstanding balances. This ensures transparent and automated recovery through payroll integration.

Key Features

- Define multiple loan/advance types (e.g., Personal Loan, Travel Advance, Salary Advance).

- Set up loan amount, issue date, interest (if applicable), EMI frequency, and duration.

- Auto-calculation of EMI and total repayment schedule.

- Deduction of EMI directly from employee salary via payroll processing.

- Option to pre-close loans or reschedule EMI plans.

- Real-time tracking of paid, due, and remaining amounts.

- Audit logs for all loan transactions and approvals.

How to Use This Feature in PrismERP

➤ Create a Loan or Advance Type

Define repayment rules, interest (if applicable), and eligibility criteria.

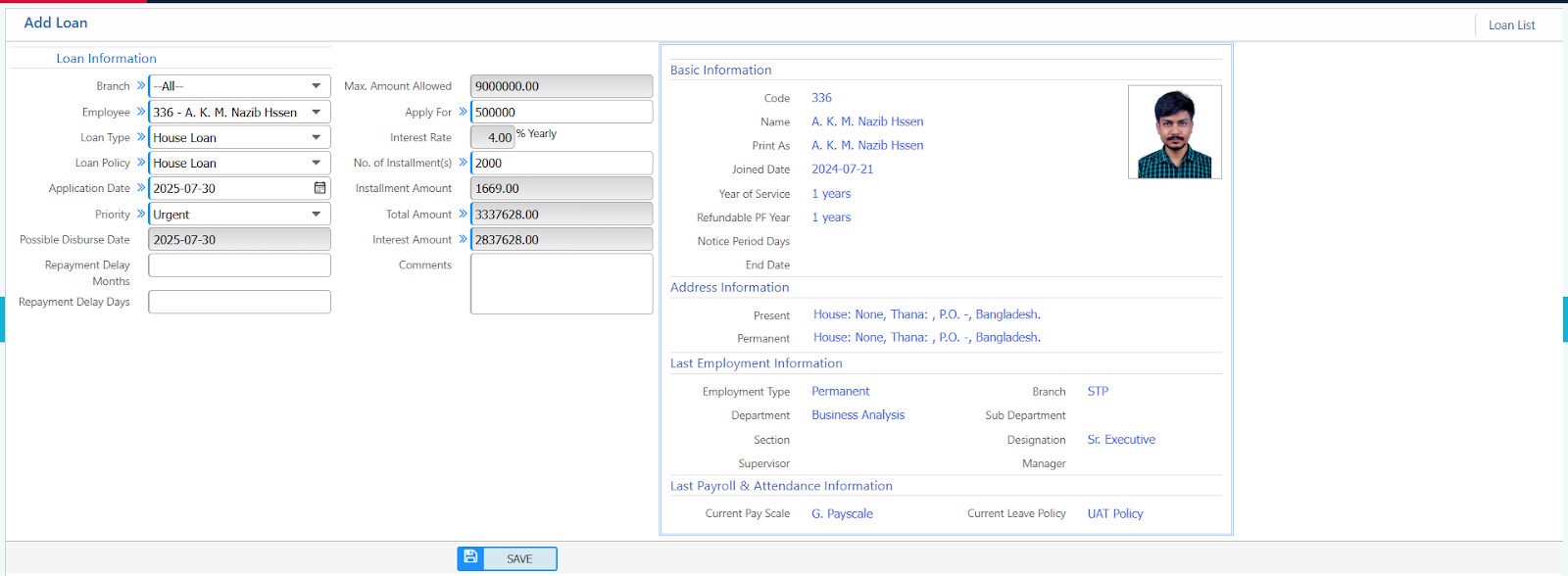

➤ Initiate a Loan Request

Enter employee details, loan amount, disbursement date, and EMI settings.

➤ System Auto-Calculates EMI

Based on the tenure, interest rate, and frequency.

➤ Approval & Disbursement

Once approved, the loan is disbursed and recorded under the employee’s profile.

➤ EMI Recovery Starts

During payroll processing, EMIs are auto-deducted and reflected in salary slips.

➤ Loan Tracking

Admins and employees can view real-time loan status, due dates, and balances.

➤ Pre-closure or Adjustment

If required, loans can be rescheduled, adjusted, or closed with a final payment.