Investment Return Manager

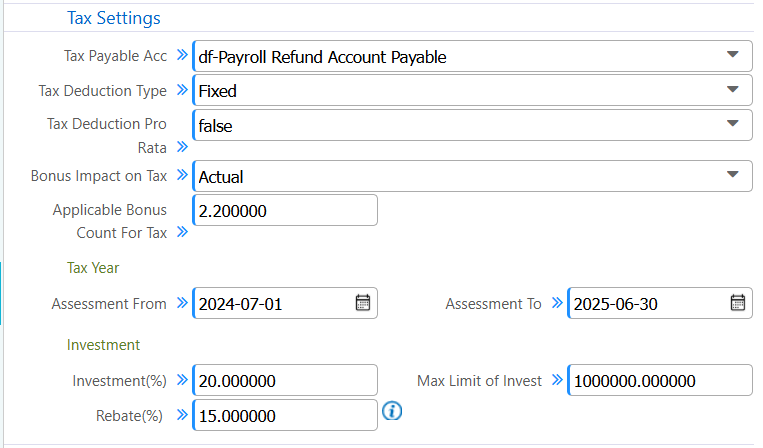

The Investment Return Manager in PrismERP is designed to capture, validate, and apply tax rebates based on employee-declared investments. It plays a crucial role in the annual income tax calculation process by allowing employees to claim eligible tax rebates under investment rules defined by the organization or local tax authority. Tax investment rules, including percentage limits and rebate rates, are pre-configured in the System Configuration → Tax Settings page.

Key Features

Centralized management of employee investment declarations.

Auto-calculates eligible investment rebate based on configuration.

Supports:

- Investment percentage (% of income)

- Rebate percentage

- Maximum allowable investment amount

Applicable tax period can be set (e.g., FY 2024-07-01 to 2025-06-30).

Tracks bonus impact and number of bonuses considered in taxation.

Integrated with Salary Tax Calculation and Tax Statement modules.

How This Helps You

The Investment Return Manager ensures employees receive rightful tax rebates for eligible investments, which encourages savings and improves employee satisfaction. At the same time, it helps organizations stay compliant with tax laws by:

- Automatically validating investment declarations against predefined rules.

- Reducing manual errors in rebate calculations.

- Saving time during tax filing and year-end processing.

- Helping HR/Finance teams generate accurate and regulation-compliant tax statements.

By centralizing the logic under the System Configuration, organizations ensure consistency across all employee records and minimize compliance risks.

How to Use this Feature in PrismERP?

A. Set Up Investment Rules:

Go to System Configuration Tax Settings.

Set:

- Investment (%) – e.g., 20% of taxable income.

- Rebate (%) – e.g., 15% rebate on eligible investment.

- Max Limit of Invest – e.g., 1,000,000 BDT.

Define applicable tax year, bonus impact, and tax deduction type (e.g., Fixed).

Save the configuration.

B. Manage Employee Investment Declarations:

Go to Payroll Tax Management Investment Return Manager.

Select an employee and fiscal year.

Input declared investment amount and upload supporting documents if required.

The system automatically:

- Calculates eligibility based on set rules.

- Applies the corresponding rebate during Salary Tax Calculation.

C. Review and Reporting:

Use Tax Statement module to verify applied rebate and ensure it is reflected in annual reports.

Export reports for submission or internal audit.