Salary Tax Calculation

The Salary Tax Calculation feature in PrismERP automates the computation of income tax deductions during payroll processing. It uses pre-defined tax rules and recognizes whether each payroll item is taxable or exempt, ensuring accurate and compliant tax handling for each employee.

Key Features

Automated tax computation based on configured tax rules.

Item-level taxability control — each payroll component (e.g., basic, bonus, allowance) can be marked as taxable or non-taxable.

Integration with employee profiles, salary structures, and payroll modules.

Supports multiple tax slabs and progressive tax calculations.

Real-time tax deduction visibility in payslips.

Dynamic adjustment for salary revisions, bonuses, or changes in tax policy.

Annual tax projection and monthly deduction scheduling.

How This Helps You

Proper salary tax deduction is essential for legal compliance, employee trust, and financial accuracy. This feature allows the organization to: Stay compliant with national income tax laws.

Minimize manual errors in tax calculations.

Provide transparent payslip information with clear tax deductions.

Easily adjust taxation logic by flagging payroll items as taxable or exempt.

Ensure efficient payroll processing without delays in month-end operations.

Generate accurate tax reports for submission or internal audit.

How to Use this Feature in PrismERP?

Set up tax rules from Payroll Tax Rules Configuration.

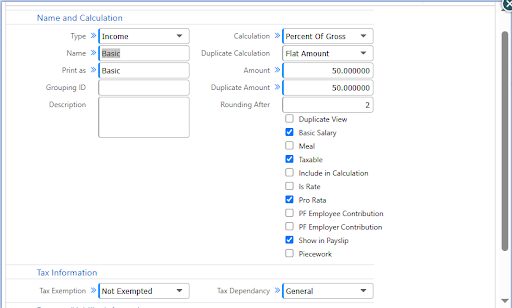

Define each payroll item (e.g., Basic Pay, House Rent, Bonus) under payroll settings, specifying whether the item is taxable or non-taxable.

During salary processing:

The system evaluates each component of the employee’s salary.

Tax is calculated only on items marked as taxable.

Applicable tax slabs and employee profile data are used.

Review the system-generated tax deduction.

The calculated tax amount is included in the monthly payslip.

Export or view tax reports for individual employees or payroll batches.