Tax Exemption Policy

The Tax Exemption Policy feature in PrismERP allows organizations to define how employee earnings are treated for income tax purposes. It enables classification of employees or income items based on their tax exemption status—whether fully, partially, or not exempted at all. This provides flexibility in handling various government-approved exemptions or organizational policies.

Key Features

Support for three levels of tax exemption:

- Not Exempted: Full income is taxable.

- Partially Exempted: A defined portion of income is exempt from tax.

- Fully Exempted: Entire income or benefit is excluded from tax calculation.

Additional capabilities:

- Can be applied at both employee level and payroll item level.

- Works in sync with salary tax calculation and payroll generation.

- Automates tax adjustment during payroll processing based on exemption category.

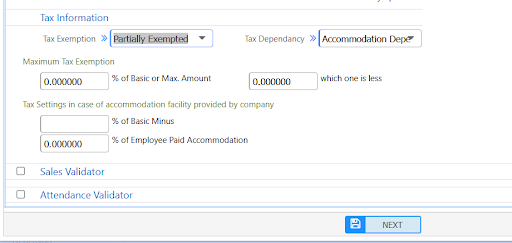

- Option to customize exemption amounts or percentages for partial exemptions.

- Integrated with employee profiles and tax reporting modules.

How This Helps You

In many organizations and tax jurisdictions, certain employees or components of compensation may qualify for full or partial tax exemption due to:

- Government service status

- Special allowance policies

- Retirement or disability benefits

- Policy-driven exclusions

This feature allows organizations to align with legal and organizational tax policies without manual intervention. By configuring exemption levels properly:

- You ensure compliance with tax regulations.

- Simplify payroll operations.

- Avoid miscalculations and penalties.

- Provide accurate payslips and employee trust in net earnings.

- Prepare correct tax reports with exemption details for auditors or tax authorities.

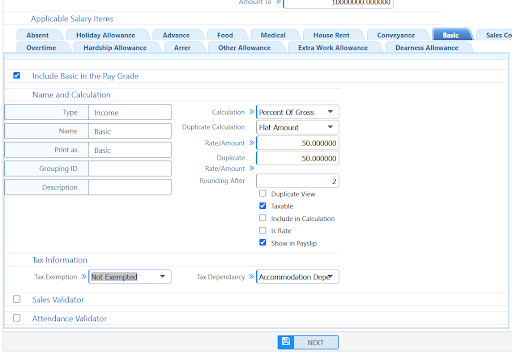

How to Use this Feature in PrismERP?

-

Navigate to the Tax Exemption Policy settings under the Payroll or Tax Management module.

-

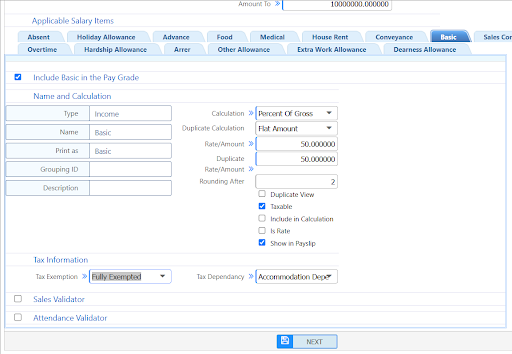

For each employee or payroll item, select one of the three exemption statuses:

- Not Exempted: System includes 100% of the item in taxable income.

- Partially Exempted: Define a fixed amount or percentage that is exempt.

- Fully Exempted: The entire item or employee earnings will be excluded from tax.

-

During salary processing, PrismERP applies the exemption logic automatically.

-

Review monthly deductions and verify exemptions are correctly reflected in:

- Payslips

- Payroll reports

- Tax summaries