Tax Rules Configuration

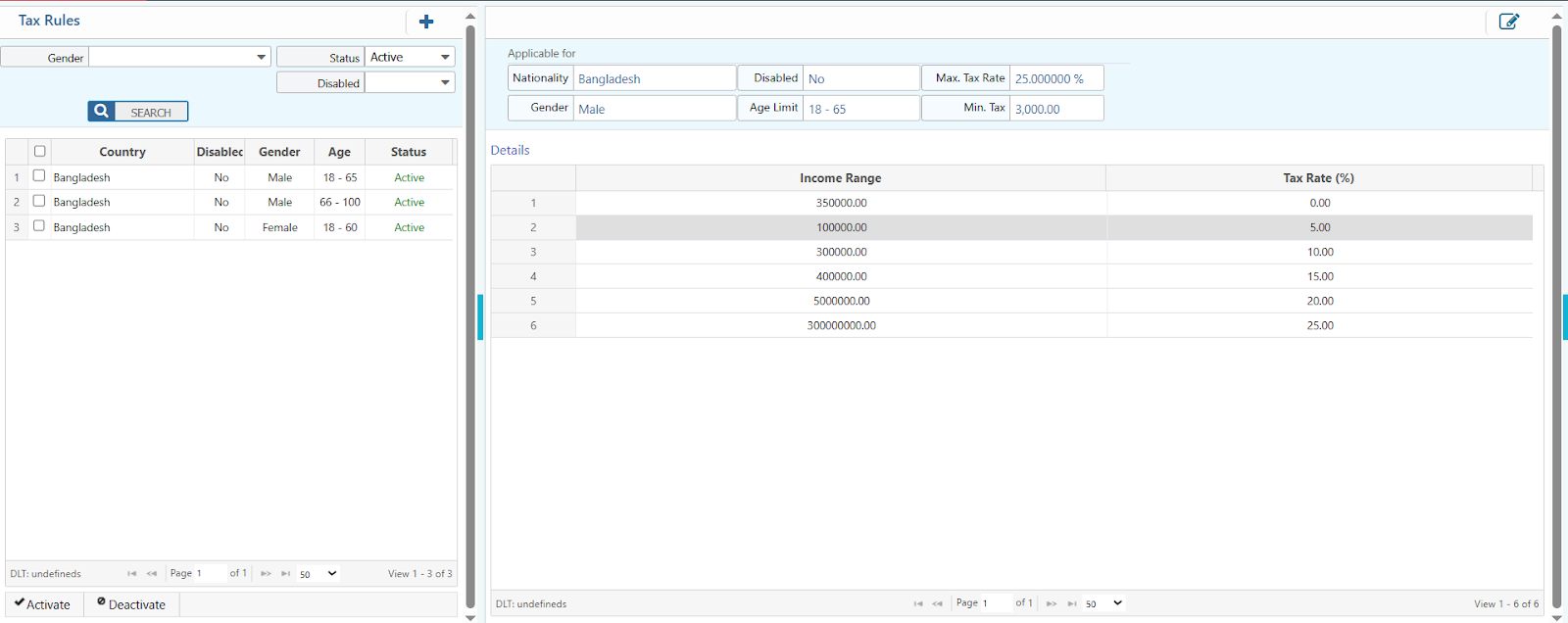

The Tax Rules Configuration feature in PrismERP allows organizations to define and manage dynamic tax slabs based on employee demographics such as nationality, gender, age, and disability status. This ensures accurate and legally compliant tax deduction, aligned with local tax regulations, such as the progressive income tax structure in Bangladesh.

Key Features

- Configure tax rules based on Nationality, Gender, Age, and Disability status.

- Define Income Ranges with corresponding Tax Rates (%).

- Set Minimum Tax Amount and Maximum Tax Rate cap.

- Option to Activate/Deactivate specific rules as needed.

- View existing tax rules in a filterable and searchable table.

- Real-time integration with payroll for automatic tax calculation during salary processing.

How to Use this Feature in PrismERP?

Step-by-Step Process:

-

Navigate to Tax Rules Configuration

-

Add a New Tax Rule:

- Click the “+” icon or Add New button.

-

Set Applicability Criteria:

- Nationality: (e.g., Bangladesh)

- Gender: Male / Female / Other

- Age Limit: (e.g., 18–65)

- Disability: Yes / No

-

Input Income Ranges & Tax Rates:

- Example:

- Up to 350,000 = 0%

- Next 100,000 = 5%

- Next 300,000 = 10%

- And so on...

- Example:

-

Set Tax Thresholds:

- Minimum Tax: e.g., 3,000 BDT

- Maximum Tax Rate: e.g., 25%

-

Save the Configuration:

- The new tax rule will be saved with status set to Active (default).

- You can deactivate any rule if required later.

-

Payroll Integration:

- During payroll processing, PrismERP will automatically apply the correct tax rule based on the employee’s demographics and income.

Conclusion

With PrismERP’s Tax Rules Configuration, your organization ensures precise tax compliance, eliminates manual work, and supports tailored tax setups for a diverse workforce—all while integrating seamlessly with payroll operations.