Tax Statement

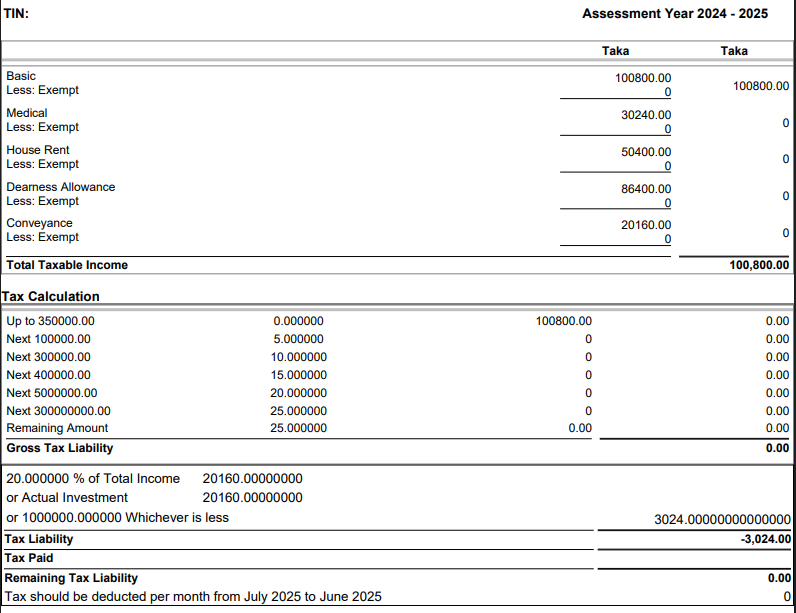

The Tax Statement feature in PrismERP provides a comprehensive summary of an employee's income, deductions, exemptions, investments, and applicable tax calculations for a specific financial year. It acts as a consolidated report used for internal review, employee reference, and submission to tax authorities, ensuring transparency and compliance.

Key Features

Generates yearly tax statement for each employee.

Includes:

- Gross earnings

- Taxable income

- Tax-exempt components

- Investment rebates

- Monthly and total tax deductions

Reflects employer contributions and other relevant details.

Supports downloadable PDF or printable format.

Consolidated view for HR/Admin to audit and finalize tax returns.

Automatically reflects data from:

- Salary Tax Calculation

- Investment Return Manager

- Exemption Policies

- Payroll Components (Taxable/Non-taxable items)

How This Helps You

Tax Statement is essential for maintaining transparency and accuracy in payroll tax management. It allows employees to:

- Understand how their annual tax liability is calculated.

- Review which salary components were taxable, and which were exempt.

- See the impact of investment declarations on tax rebate.

- Check monthly tax deductions made through payroll.

For HR or finance teams, this feature provides:

- A standardized document for tax reporting to NBR (Bangladesh) or relevant authorities.

- Simplified preparation of Form 16 equivalents.

- Efficient tracking of employee-wise tax deduction trends.

- Assurance of compliance with local tax rules.

How to Use this Feature in PrismERP?

After configuring tax rules and completing salary processing:

- Ensure all employee earnings, exemptions, and investments are up to date.

- Navigate to the Tax Statement section under the Payroll Tax Management module.

- Select the financial year and employee(s) for whom you want to generate the statement.

The system will automatically consolidate:

- Gross salary details

- Taxable & exempted income

- Rebate from declared investments

- Monthly deducted tax

Download or print the tax statement for:

- Internal distribution

- Government reporting

- Employee submission with tax returns